The grocery industry is built on trust. Grocers rely their suppliers to deliver high-quality products on time. And consumers expect to find the products they need at the prices they can afford at local grocers.

For decades, this trust has enabled the grocery industry to thrive. But when the pandemic hit, people felt unsafe venturing out to grocery stores with hundreds or even thousands of potentially sick customers.

The trust between grocers and its customers was eroding before our eyes. But, people must eat to survive.

Enter ecommerce grocery software.

The boom in online grocery shopping was phenomenal. Instacart, in particular, saw a surge in its app usage, making it the #1 grocery delivery app in the US.

But again, the grocery industry is built on trust. And right now, Instacart’s on thin ice after undermining the confidence of not just consumers, but its “workers” and grocery clients too.

Let’s look closer at how and why trust is fading and what you can do to save your grocery store from the fallout.

The rise of Instacart as a “Savior” for grocers and consumers

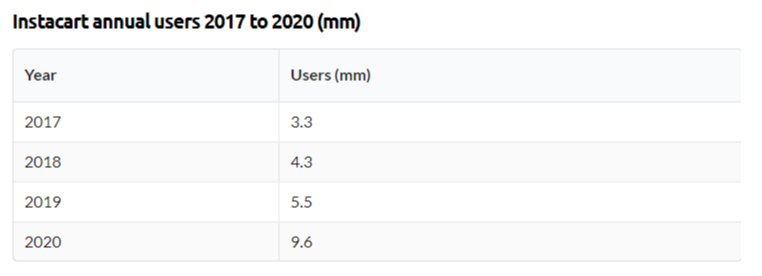

Before the pandemic: Instacart had 5.5 million app users, with a steady climb of roughly one million new users yearly.

After the pandemic: Instacart usage soared to 9.6 million.

Makes sense. After all, people were stuck at home during lockdowns and needed to fill their fridges and families’ stomachs with food. And for a time, this panned out for everyone:

- Grocers continued to sell goods during lockdowns and in-store restrictions

- Consumers could safely shop for food from the comfort of their home

- People had a side gig to keep money flowing while their day jobs were shut down

Sometimes the strain of a rapid rise can do more harm than good, especially if the company isn’t equipped to handle it. A sudden increase in demand means a sudden need for more workers and the funds to pay them.

Unfortunately, during the first years of Instacart’s existence, it failed to turn a profit (hurting its ability to pay its workers appropriately). It wasn’t until 2020, after the pandemic, that it finally had a profitable month — roughly $10 million in net revenue. By the end of the year, it profited $50 million, up from -$300 million in losses the previous year.

However, even with this improvement, things aren’t on the up and up for the ecommerce grocery app. Its evaluation dropped from $39 billion in 2021 to $34 billion in 2022.

The question is whether it’ll remain at the top now that the pandemic’s over and more ecommerce grocery delivery options are on the scene. Here’s a look at why we say no.

How Instacart is hurting grocers and consumers

Consumers today are savvy. So naturally, Instacart was a ticket to getting what they need without leaving the house during the Covid outbreak. And even after the pandemic subsided, many consumers and grocers still use the service they’ve become accustomed to.

But this is changing because of the following five reasons.

1. Inflating food prices and platform fees

Everyone’s feeling the pain of inflation. According to BLS.gov, consumer products and services costs are up 9.1%, the highest increase in the last 40 years. And it’s not just for food, but across all sectors of consumer products:

Source

With this in mind, you’d think the ecommerce grocery app would help consumers by lowering prices to remain competitive. But no, Instacart instead raised food prices ordered through its app to cover its platform fees.

What’s worse is most consumers don’t realize the marked-up price unless they compare it in person or read the fine print. So not only are consumers responsible for the delivery and service fees (which is also up 24% year-over-year), they’re losing money on overpriced products too.

This hidden cost is causing some buyers to pay 24% more for certain groceries. Then adding on the service rate, delivery fee, and tip, can lead to customers spending 35% or higher than getting groceries in-store.

Not good for your business. Not only is it hurting your profit margins, it also makes it harder for you to be competitive with other retailers.

Mark Skogen, CEO of Skogen’s Foodliner Inc., told The Wallstreet Journal that they don’t make money from Instacart orders. His store pays Instacart a cut of its online sales, which increases revenue, but yields no profit.

Fortunately, there are alternative ecommerce grocery software grocers can use, which we’ll discuss below.

2. Delivering a poor brand experience for grocers

Consumers like to shop with the same stores and brands they trust. However, with the current market, many consumers are going wherever they can find the products they need at the cheapest price.

Instacart makes this easier to do by offering various products from different grocery stores (aka your competitors). Good business for Instacart — for you, not so much.

When you partner with Instacart, you’re just another grocery store listed on the app. There’s no way to compete with grocers virtually, which leaves you losing customers to the lowest bidder.

It’s impossible to build a brand and loyalty this way, so why should grocers continue putting up with this? Well, they don’t have to now that better alternatives exist.

3. Owning your customers’ data

With Instacart, you can’t control the prices of your goods. Nor can you control your brand experience. Now, throw on top that you don’t own your customers’ data. So if Instacart decided to one day close its doors or charge extra fees you disagree with, you have to part ways without that precious information.

Why’s this a major problem?

Because it removes your ability to learn your customers’ habits so you can remarket to them to grow sales and customer loyalty. It’s a problem you wouldn’t have if you used your own app, or an ecommerce grocery software that allows you to keep and use all of your customer data.

If you haven’t already made the switch, make this the year you build relationships with online shoppers.

4. Changing their model to focus on CPG ad revenue

Then to add salt to injury, Instacart is changing its business model that’ll have a major impact on your grocery store. To diversify revenue, it’s focusing more on CPG ad revenue.

For the Super Bowl in 2023, the ecommerce app partnered with Michelob Ultra to launch its first major CPG marketing campaign. The campaign included shippable ads consumers could click to purchase game-day snacks.

These ads appeared during the NFL playoff games and allowed viewers to scan QR codes in the ad to make a purchase. The link took consumers to Michelob’s Instacart page, where they could browse and add more products to their cart before checking out.

According to Instacart, it was one of its biggest investments to “enable CPG brand partners to create campaigns that truly deliver.”

In 2021, the platform generated $580 million in advertising revenue, showing its commitment to growing CPG revenue (at your expense).

So not only are grocers competing for other stores listed in Instacarts’ app — now they must toss money into big campaigns to outperform competitors. This means even less control over the shopping experience and brand relationships.

It’s a potentially expensive game plan that could result in a fumble if you lack the budget and strategies to compete.

5. Turning grocery stores into glorified dark warehouses

The popularity of Instacart is a double-edged sword. On one end, you may be getting a lot of sales, boosting your overall revenue. But on the other, the influx in purchases is hurting the in-store experience.

On most days, you may have dozens of shoppers going in and out of your grocery store pulling items off of shelves in a flurry. This creates issues with:

- Clogged aisles

- Out-of-stock items

- Longer checkout lines

- Unruly Instacart shoppers

In the end, you’re turning your store into a glorified dark warehouse. This can make you lose customers to competitors that want a pleasant in-store experience.

Not a total surprise when you have shoppers you undercut in payment. Not long ago, Instacart saw a backlash for using shoppers’ tips to cover their base pay.

Heinen, a grocer with over 75k stores in North America, chose to part ways with Instacart after nearly six years. The reason: to have more control over its customer experience. The grocer stated that it wants to deliver the same experience customers receive in-store.

Smart move.

If you want to avoid these five problems in your grocery stores, then it’s time to switch from Instacart and adopt an ecommerce grocery software that works for not against your business.

Remove the Trojan Horse in your grocery business with Stor.ai

You trusted Instacart to give your grocery store a boost. Yet, there are too many issues hurting your business’s potential. Not only are you dealing with inflated costs and loss of control over your brand image and in-store experience. You’re also setting yourself up for a potential take-down.

Some are calling Instacart a Trojan Horse waiting to enter the grocery industry, becoming a competitor seemingly over night. And guess what they’ll have that you don’t — your customers’ data.

The good news is you can avoid all of this by making the switch to Stor.ai. Stor.ai is an ecommerce grocery software that puts you in control of your grocery business. You’ll be able to:

- Collect and own customer data and build relationships with them

- Create a personalized shopping experience with product recommendations

- Grow sales through remarketing campaigns

- Build your brand and customer loyalty using personalized email marketing and a white-label app that shows your logo

- Advertise specific products to improve visibility and sales

- Train in-store employees in pick and packing with our app (no unruly outsiders)

- Control the in-store experience with the help of your in-house fulfillment team

- Improve the in-store and grocery delivery experience

Control your prices to be more competitive and fair

Stor.ai is a renowned platform that’s used by over 500 retailers in eight countries across the world. And to date, we’ve processed over $1B in grocery ecommerce sales and helped grocers generate a 12:1 return on digital investment.

If you’re ready to build an ecommerce shopping experience you control and actually profit from, then book a demo with Stor.ai today!